Overnight rates are for indicative purposes only. All income of persons other than a company limited liability partnership co-operative or trust body are assessed on a calendar year basis.

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Director deemed interest rate malaysia 2018 20182019 Malaysian Tax Booklet 22 Rates of tax 1.

. Determination of interest income deemed to be received by the company is based on prescribed formula with the Average Lending Rate ALR published by Bank Negara Malaysia. The IRBM also issued PR82015 on Loan or Advances to Director by a Company to explain on the tax treatment of interest income deemed to be received by the company from the loans or advances to directors of the company without interest or with interest rate lower than the arms length rate. Deposit Interest Rate in Malaysia is 156 in 2022.

Deposit Interest Rate In Malaysia 1980 2019 Data 2020 2021 Forecast Historical. Deposit Interest Rate in Malaysia averaged 475 percent from 1980 until 2021 reaching an all time high of 975 percent in 1982 and a record low of 156 percent in 2021. Total Deemed Interest held pursuant to Se.

325 Maybank Maybank Islamic Berhad The Highest Base Rate BR. The interest income for the basis period for a. These rules and guidelines follow the proposal of the limitation in the 2019 budget 2 released on 2 November 2018 and enacted.

In this scenario the interest income to be disclosed as earned in the tax return is RM408333. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018. Corporate companies are taxed at the rate of 24.

If the company charges interest of 3 on the director advance the total interest payable by the director is RM245000 which is less than the deemed interest of RM408333. 112 x A x B. 20182019 Malaysian Tax Booklet 22 Rates of tax 1.

Resident individuals Chargeable income RM YA 2018. The Director General may withdraw this Public Ruling either wholly or in part by notice of withdrawal or by publication of a new Public Ruling. This Deemed Interest Income From Loan Or Advances To.

9 1 See Directors Conflict of Interest in Lee Hishammuddin Allen Gledhills Legal Herald June 2018 issue p 21 2 Wong See Yaw Anor v Bright Packaging Industry Bhd 2016 6 CLJ 465 3 Adoption of constitution is now not mandatory for a private company. Deemed Interest Rate Malaysia 2018 Get link. 33 Taxable income and rates 34 Capital gains taxation 35 Double taxation relief 36 Anti-avoidance rules 37 Administration 40 Withholding taxes 41 Dividends 42 Interest 43 Royalties 44 Branch remittance tax 45 Wage taxsocial security contributions 46 Other withholding taxes.

Company that provides loan or advances to directors from its internal funds shall be deemed to derived interest income which is assessable under Section 4 c of Income Tax Act 1967 ITA. For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24. This page includes a chart with historical data for Deposit Interest Rate in Malaysia.

Effective from YA 2014 it is proposed that a Company is deemed to have gross income consisting of interest from loan or advances to directors. Revenue Board of Malaysia. D rents royalties or premium.

Historical Chart by prime ministers Deposit Interest Rate in Malaysia by prime ministers. Compare Interest Rate by Country. Total Deemed Interest held pursuant to Section 8 of the Companies Act 2016- Deemed Interest No of Shares ----- ----- Dynamic Milestone Sdn Bhd 161401000 Podium Success Sdn Bhd 1950000.

June 2018 is the FY ending 30 June 2018. Of director and not from his employment in an executive or management position. Malaysia adopts a self-assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer.

The interest income for that basis period shall be the aggregate sum of monthly interest in that basis period. And Base Financing Rate BFR as at 21 December 2018 by Bank Negara Malaysia. Check out the listing here.

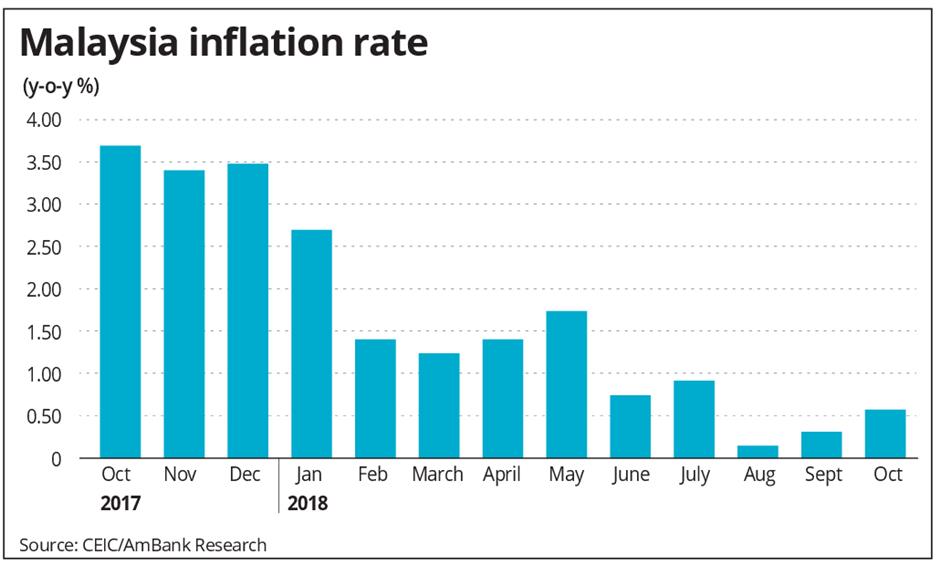

It sets out the interpretation of the Director General in respect of the particular tax law and the policy as well as the procedure applicable to it. Malaysia Raises Key Rate to 225. Malaysia Taxation and Investment 2018 Updated April.

Is The Negative Interest Rate Policy Effective Sciencedirect. A place of business as defined in Malaysia is also deemed derived from Malaysia wef the date the relevant law comes into effect. BI 51 - 57indd 173 102117 138 AM.

Home Directory Market Market Overview Market Screener Market Map Exchange Rates Login Register 4453754400. On 28 June 2019 Malaysia issued rules the Rules on the interest deductibility limitation. 1 On 5 July 2019 the Malaysian Inland Revenue Board the IRB released guidelines the Guidelines to supplement the Rules.

For the purposes of section 140B of the ITA the company is deemed to receive interest income on loans given to the directors from internal funds from 142014. The interest income is calculated based on the formula -. For Malaysia Overnight Rate MYOR please go here.

A is the total amount of loan or advances outstanding at the end of the calendar month. The central bank of Malaysia raised its key overnight policy rate by 25 basis points to 225 in its July 2022 meeting the second consecutive rate hike and in line with market expectations. Rate of Interest Loan Period Date the Loan and Interest is Due to be Paid 5 non- cumulative 3 years 31122016 Interest payable for each year of assessment is as follows.

Actual data on average rate that banks pay to deposit account holders in Malaysia. E pensions annuities or other periodical. Deposit Interest Rate in Malaysia decreased to 156 percent in 2021 from 196 percent in 2020.

The Lowest Base Rate BR. Https Mpra Ub Uni Muenchen De 87576 1 Mpra Paper 87576 Pdf. The sum of the monthly interest is determined.

472 Bangkok Bank Berhad. Effective from 2 January 2015 the Base Rate replaced the Base Lending Rate as the main reference rate for new retail floating rate loans. Year of Assessment 2014 Year of Assessment 2015 Year of Assessment 2016 Interest - RM2000 Payable for 112014 to 31122014 but only due to be paid on 31122016.

Home Interest Rates Update The latest Base Rate BR Base Lending Rate BLR and Base Financing Rate BFR as.

Director Deemed Interest Rate Malaysia 2018 Madalynngwf

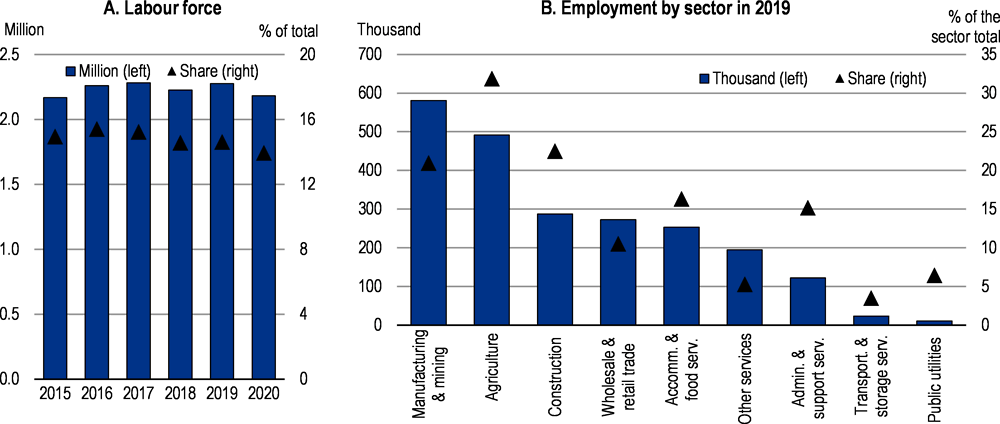

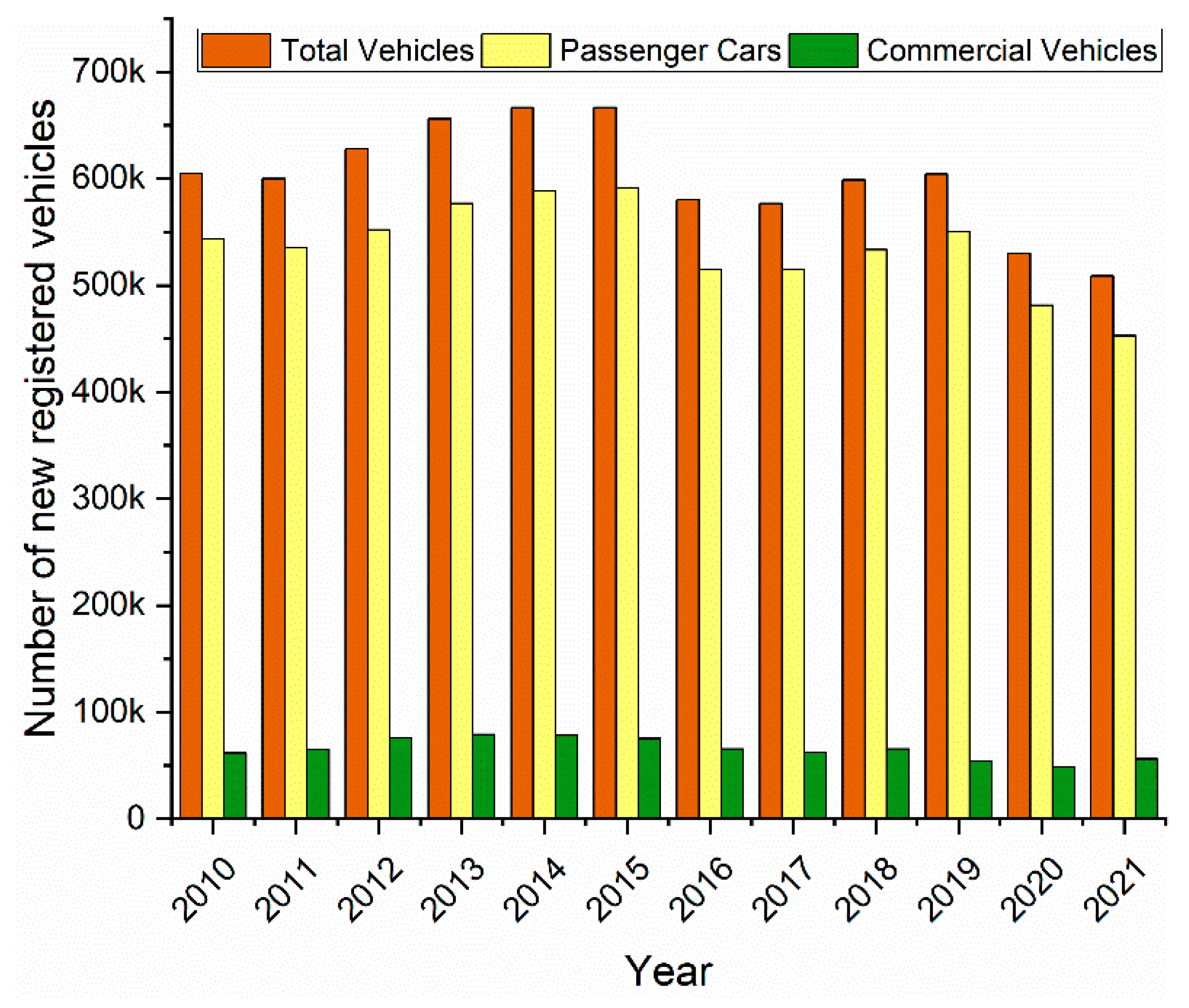

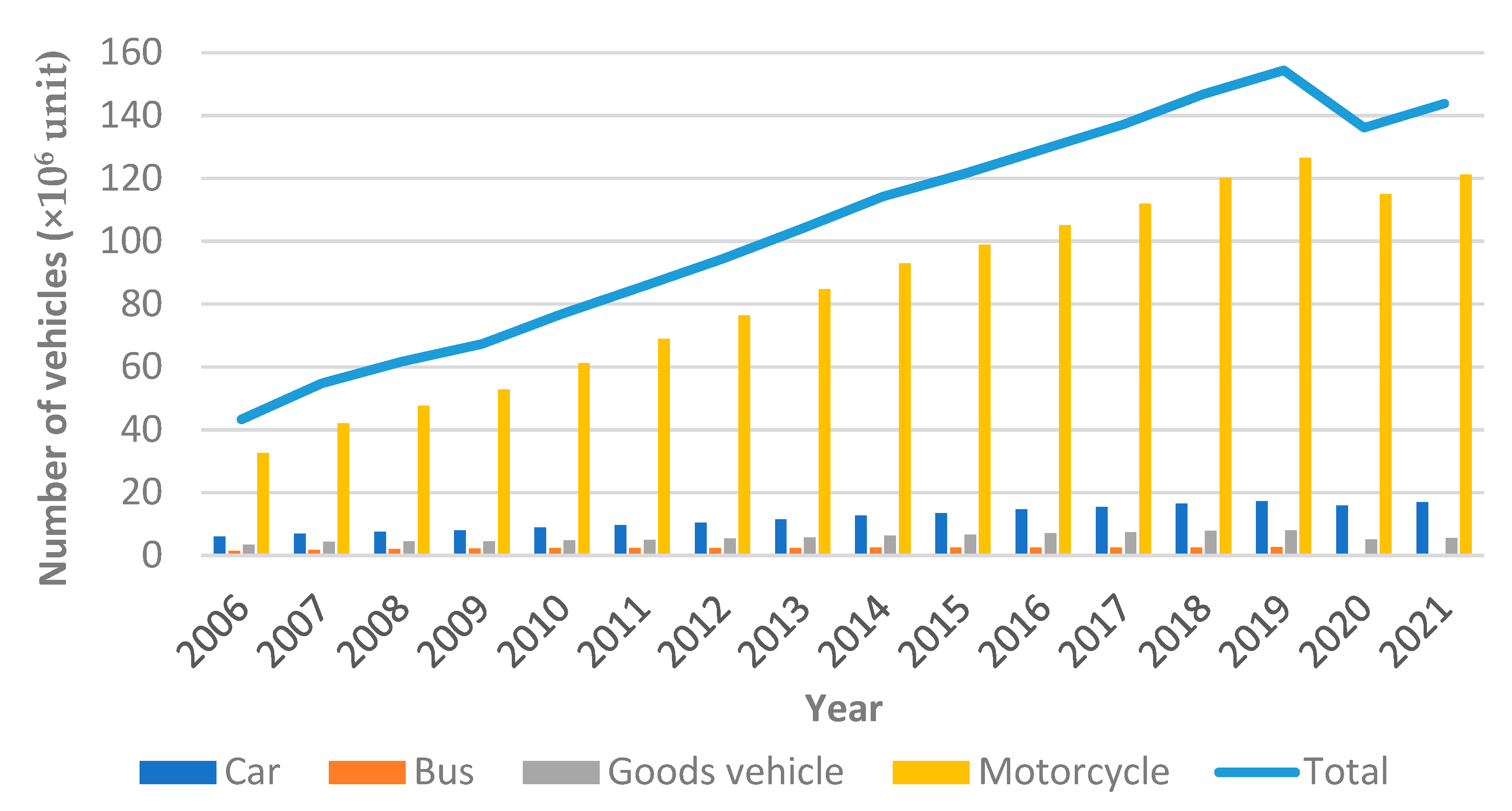

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

Malaysia Election Results Parliamentary Seats 2018 Statista

Frontiers Lack Of Self Efficacy And Resistance To Innovation Impact On Insufficient Learning Capabilities Mediating The Role Of Demotivation And Moderating The Role Of Institutional Culture

Malaysia Interest Rate Malaysia Economy Forecast Outlook

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

Malaysia S Key Overnight Policy Rate Likely To Remain At 3 25 The Star